does doordash do quarterly taxes

The Federal Insurance Contributions Act FICA requires a tax on employees wages as well as contributions from employers in order to fund the USs Social Security and Medicare programs. The forms are filed with the US.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Explore the latest videos from hashtags.

. My understanding is that 1099 individuals who anticipate having to pay over 1000 in taxes at the end of the year must pay quarterly taxes in addition to the year-end tax process. Be aware the due dates arent exactly quarterly. You do PAY quarterly taxes if you expect to owe more than 1000 in taxes by the end of the year.

The Doordash tax impact calculator. Then I adjust it at end of year to more or less miles as needed. I have a w2 job and DD is just a side thing.

Dashers should make estimated tax payments each quarter. If youre wondering why that is what I understand is it goes back to a day when the government actually relied on real money instead of just printing up. Cynswizzlebalarkey Lexjustlexx Tax Professional EA dukelovestaxes tcoochiefettuccine Doordash Deliverydoordashdelivery1.

You only file your taxes once a year like anyone else. Discover short videos related to what does doordash mean on TikTok. Last year on 57000 income betweeen DoorDash and postmates I paid 390 in taxes.

Watch popular content from the following creators. Paper Copy through Mail. Why is this important.

You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits. How do Dashers pay taxes. Restaurant owners are then required.

If Dashing is a small portion of your income you may be able to increase your income tax withholding at your day job instead of paying quarterly taxes. I personally keep a mile log in notes on my phone. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash.

Here are the due dates for 2021. Save money each week as though its your own form of withholding send in what you saved each quarter as an estimated tax payment. However you still need to report them.

Not that it matters but heres the story on why its so wonky. So if you have other income like W2 income your extra business income might put you into a higher tax bracket. Calculate your income tax and self-employment tax bill.

There are four major steps to figuring out your income taxes. Unfortunately that is not how it works with DoorDash because you are an independent contractor meaning your are essentially a self-employed business. Federal income taxes apply to Doordash tips unless their total amounts are below 20.

Add up all of your income from all sources. Im new to this independent contractor business and come from the corporate world so not familiar with the concept of quarterly taxes. Yes - Cash and non-cash tips are both taxed by the IRS.

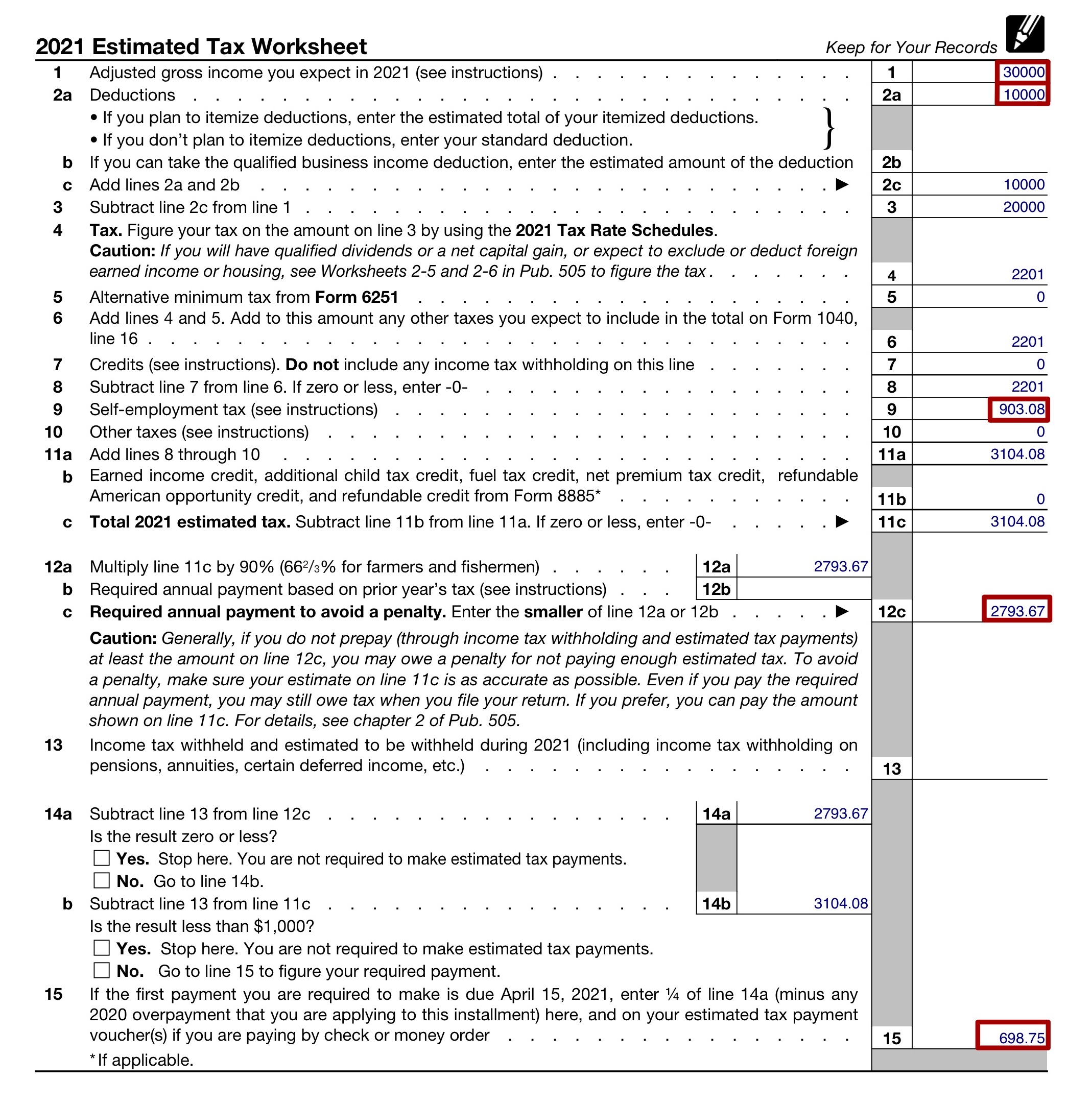

Apply previous payments and credits to the tax bill and figure out if you pay in or get a refund. If you expect to owe the IRS 1000 or more in taxes then you should file estimated quarterly taxes. This means you will be responsible for paying your estimated taxes on your own quarterly.

These quarterly taxes are due on the following days. Your cash tips are not included in the information on the 1099-NEC you receive from Doordash. Do you pay taxes on Doordash tips.

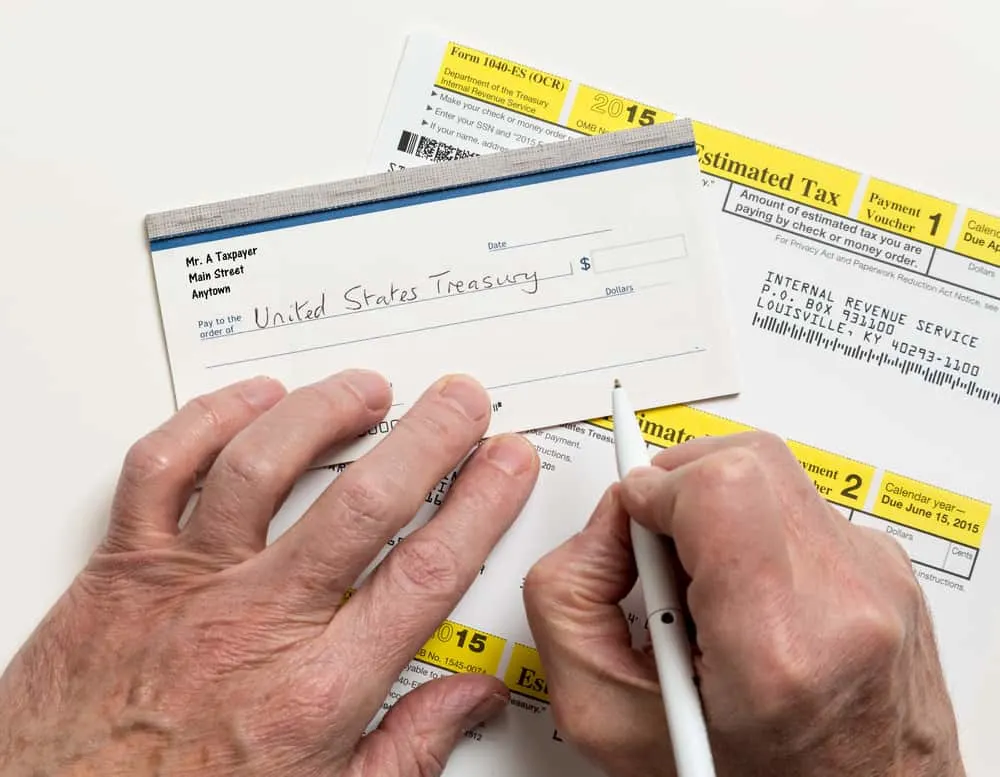

You can click here to access the calculator. How do you feel as a Grubhub Doordash Uber Eats Postmates contractor when it comes to thinking about quarterly estimated taxes. Instructions for doing that are available through the IRS using form 1040-ES.

You can also use the IRS website to make the payments electronically. If youre a Dasher youll need this form to file your taxes. Youll be prompted to enter how much you made how much you think.

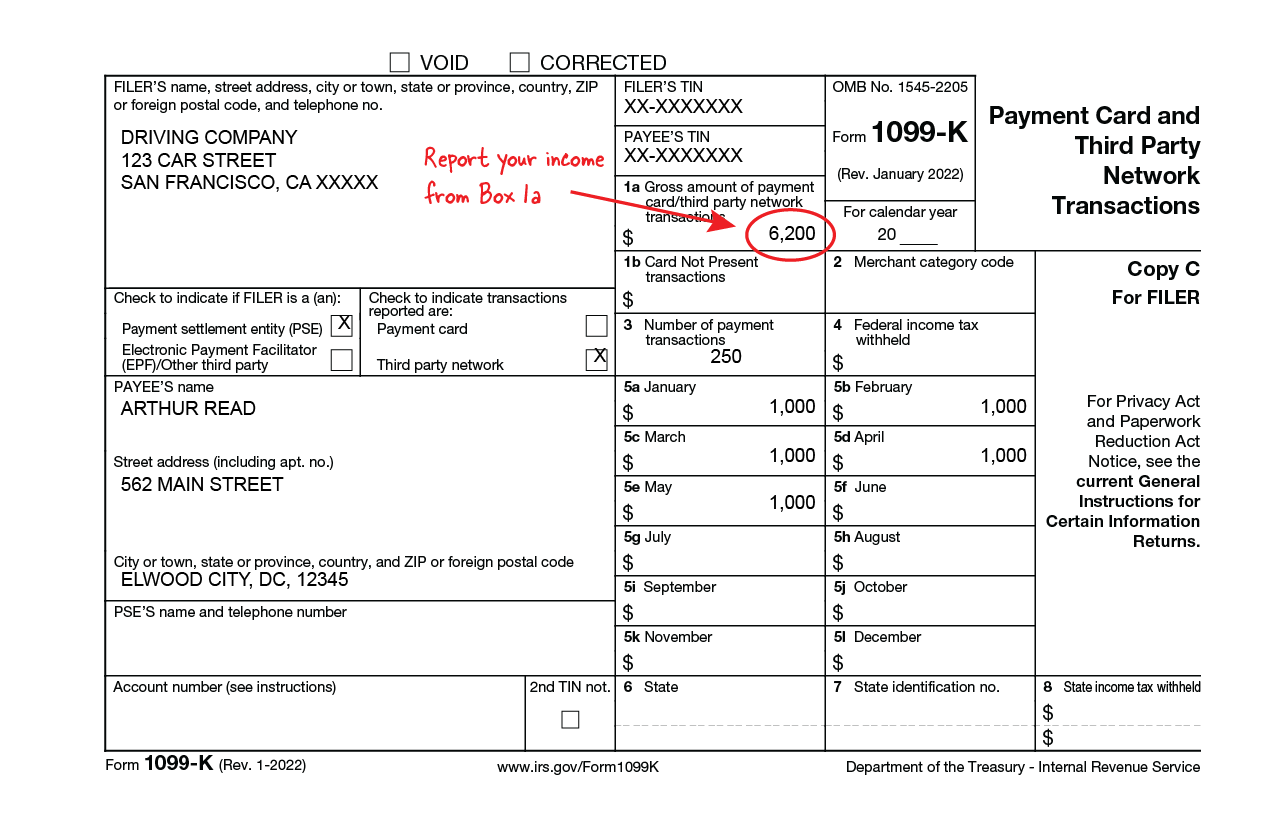

Last year made 7k from DD and saved about 1500 hundred for tax purposes. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US. For 2021 all employers must withhold 62 for Social Security and 145 for Medicare from employees gross wages.

If you fail to pay your. Well You estimate the taxes that will be owing on your earnings. You will pay to the Federal IRS and to the State separate taxes.

This way i decide how many miles i went a day if you get my drift. Internal Revenue Service IRS and if required state tax departments. Make sure to pay estimated taxes on time.

E-delivery through Stripe Express. A better plan is to develop an idea throughout the year of what to set aside. Do you owe quarterly taxes.

You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply. Ended up only owing IRS about 250 so essentially had 1250 in tax returns which is about my usual amount. - If you are eligible for e-delivery you will receive an email invitation the subject of the email is Review your.

Answer 1 of 4. Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021. I save about 25 of my DD earnings in a separate account.

If you wait until April to pay you could have to pay a penalty if you owe. If youre purely dashing as a side hustle you might only have to pay taxes one a year. Since youre an independent contractor you might be responsible for estimated quarterly taxesespecially if DoorDash is your sole source of income.

DoorDash does not take out withholding tax for you. Each quarter youre expected to pay taxes for that quarters payment period. You do not FILE quarterly taxes.

It may take 2-3 weeks for your tax documents to arrive by mail. Reduce income by applying deductions.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

A Beginner S Guide To Filing Doordash Taxes 4 Steps

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

Form 1099 Nec For Nonemployee Compensation H R Block

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

A Beginner S Guide To Filing Doordash Taxes 4 Steps

How Do I File Estimated Quarterly Taxes Stride Health

Doordash Taxes 2022 A Complete Guide For Dashers By A Dasher